The Buzz on International Debt Collection

Wiki Article

Personal Debt Collection Things To Know Before You Buy

Table of ContentsPrivate Schools Debt Collection for DummiesUnknown Facts About Personal Debt CollectionGetting The Business Debt Collection To WorkNot known Facts About Dental Debt Collection

Debt collection agencies have an online reputation for bugging customers. (FTC) obtains more issues about debt enthusiasts as well as financial obligation purchasers than any type of other single sector.

An enthusiast that acts appropriately will be fair, respectful, straightforward, as well as obedient. After you make a composed request for verification of the financial obligation you've been gotten in touch with aboutwhich is your legal rightthe enthusiast will certainly suspend collection activities as well as send you a composed notice of the amount owed, the business you owe it to, as well as exactly how to pay.

It will also inform the credit bureaus that the product is contested or demand that it be removed from your debt report. If the collector works as a intermediary for a financial institution and doesn't have your financial debt, it will inform the lender that it quit collection activity due to the fact that it could not validate the debt.

Credible debt collectors will attempt to obtain exact and full records so they don't go after individuals who do not truly owe cash. If you inform them the debt was brought on by identification theft, they will make a reasonable initiative to confirm your case. They likewise won't try to sue you for financial debts that are beyond the statute of restrictions.

The Only Guide to Private Schools Debt Collection

Taking even the smallest action can invalidate the law of limitations and reboot the clock. Financial debt collection is a legitimate company. If a financial debt collector calls you, it's not always violent. Numerous enthusiasts are sincere individuals who are simply trying to do their tasks as well as will certainly collaborate with you to develop a plan to assist you settle your financial debt, whether that indicates a repayment completely, a series of regular monthly settlements, or even a decreased negotiation.A debt collector can not contact you at job or outside the hours of 8 a. m. to 9 p. m. A financial obligation enthusiast can not take cash from your income unless they have consent to garnish your earnings through a court order. It is essential to try to pay off your debts to a debt collector prior to they take lawful activity.

If you are dealing with financial obligation that you are unable to pay, you have several choices, consisting of declare personal bankruptcy or negotiating a settlement with the lending institution. Nevertheless, much of your choices have drawbacks to take into consideration also, such as the fact that your credit report will likely decline. Consider seeking advice from a professional economic advisor to examine all the alternatives for managing your debt scenario.

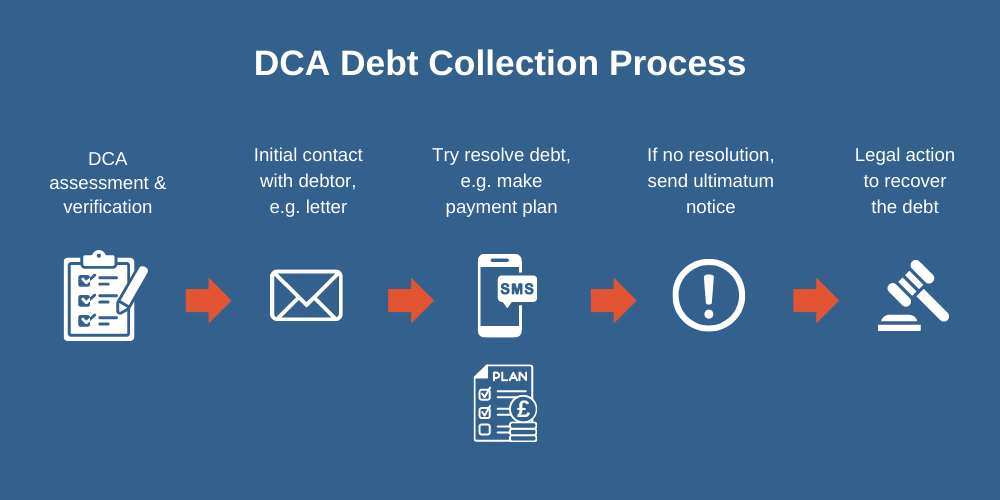

Tabulation You will probably have come across financial debt debt collection agency, yet who are they and also what can they do? A financial debt debt collection agency, also referred to as a financial obligation collection agency, deals with part of your creditors to collect financial debts you owe. Private Schools debt collection. They will deploy their representatives to contact you or visit useful site you to request any outstanding financial obligations that need to be paid off

An Unbiased View of Private Schools Debt Collection

The financial obligation collectors are likely to receive a cost from your creditors for effectively accumulating your money. Financial debt collectors might be implemented to conserve your creditors money and time. You will certainly be made aware that this is happening as well as who the debt collectors are, so you can be certain that the new individuals chasing you for money are legit.A financial debt debt collection agency can do this by: Contacting you Calling you Sending a doorstop collector to visit your house (these people have no lawful power to take anything from you, unlike a sheriff) A financial obligation collection agency is not allowed to bug and also persistently contact you. The Financial Conduct Authority's (FCA) standards state that customers have to be treated with 'forbearance and due consideration'.

If a debt debt collection agency calls your household, buddies or work coworkers without your authorization, they remain in violation of FCA assistance. In addition, if they disclose any type of information regarding your financial obligations to any individual without your authorization, they are damaging the legislation. You will be why not find out more expected to pay back your financial obligations, but you do have the right to be dealt with fairly.

To start with, you must speak to the person/company who is bothering you and ask them to just call you through one communication stream letter or phone for instance. They have a responsibility to your creditors to call you however they can not constantly send you intimidating letters or call you throughout the day

What Does Personal Debt Collection Do?

Some financial obligation monitoring firms, like Pay, Strategy, supply free guidance and also can help find you a suitable financial debt service if needed. You don't need to bother with debt alone. Learn more about debt and get complimentary, professional suggestions from Pay, Strategy at www. payplan.com, Our advisers are here to assist and they will more than happy to talk to you concerning your economic circumstance.

As a result of a small change in laws, the debtor is currently reliant pay all prices of default procedures. What this implies for you is 100% cost-free financial debt collection on effective recovery with Thomas Higgins. Under the Late Settlement of Industrial Debts (Passion) Act 1998, you are entitled to assert back the costs entailed with recuperating your debts.

By selecting Thomas Higgins for your financial debt recovery, there is no requirement for you to be out of pocket for going after money that is truly your own. With a successful insurance claim, not just are our costs covered yet as we do not charge compensation or a percentage, you will obtain every one of what is fetched from the debtor as well as at no added cost.

Report this wiki page